15+ pay calculator kentucky

CINCINNATI-WILMINGTON-MAYSVILLE OH-KY-IN Print Locality Adjustment. Well do the math for youall you need to do is enter.

174 Clay Ridge Rd Alexandria Ky 41001 Realtor Com

The process is simple.

. Kentucky Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Figure out your filing status work out your adjusted gross income. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Kentucky.

2021 Electronic Filing and Paying Requirements Effective May 5 2020 Kentuckys tax law requires employers filing on a twice monthly and monthly frequency to electronically file and. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky. Calculating your Kentucky state income tax is similar to the steps we listed on our Federal paycheck calculator.

Customize using your filing status deductions exemptions and more. On the other hand if you make more than 200000 annually you will pay. Living Wage Calculator - Living Wage Calculation for Kentucky Living Wage Calculation for Kentucky The living wage shown is the hourly rate that an individual in a household must earn.

Simply enter their federal and state W-4 information as. Examples of payment frequencies include biweekly semi-monthly or monthly. Find out how much youll pay in Kentucky state income taxes given your annual income.

For a detailed calculation of your pay as a GS employee in Kentucky see our General Schedule Pay Calculator. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Kentucky.

However below are some factors which may affect how you would expect the calculation to. All you have to do is enter each employees wage and W-4 information and. The state income tax rate in Kentucky is 5 while federal income tax rates range from 10 to 37 depending on your income.

The basic benefit calculation is easy it is 11923 of your base period wages. We designed a nifty payroll calculator to help you avoid any payroll tax fiascos. Payroll Payroll Fast easy accurate payroll and tax so you can save.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Supports hourly salary income and multiple pay frequencies. This income tax calculator can help estimate your average income.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency.

90 Charles Ford Road Hopkinsville Ky 42240 Compass

9060 Dunham Road Litchfield Oh 44253 Compass

1957 Cracraft Rd Tollesboro Ky 41189 14 Photos Mls 608776 Movoto

55042 Highway 15 Bristol In 46507 Compass

Subaru Love Promise Quantrell Subaru

Lyndon Square 55 Senior Apartments 911 Ormsby Lane Louisville Ky Apartments For Rent Rent

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

St Aloysius Apartments 410 West 8th St Covington Ky Rentcafe

Freebsd Handbook

Oxmoor Apartment Homes Louisville Ky Apartments For Rent

Kentucky Salary Calculator 2022 Icalculator

174 Clay Ridge Rd Alexandria Ky 41001 Realtor Com

10276 W Us Highway 60 Olive Hill Ky 41164 Mls 11040084 Zillow

Kentucky Country Day School Teacher Salaries Glassdoor

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

4805 E Kentucky Apartments 4805 E Kentucky Ave Denver Co Rentcafe

University Of Kentucky Physician Salaries Glassdoor

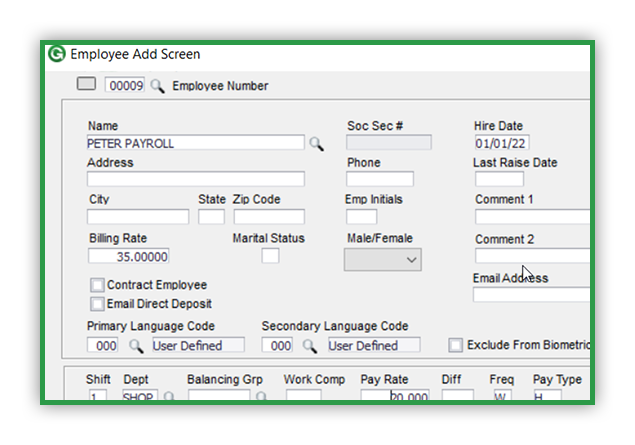

Hr And Payroll Software For Manufacturing Global Shop Solutions

Best Cell Phone Providers In Kentucky Moneysavingpro